Investment update as of 9th March 2020 from Malcolm Kilminster

Share prices have fallen today

It’s Monday morning and the fall in oil prices and the Asian stock markets overnight have led to the largest fall of the FTSE100 Index in a day since the 2008 financial crisis.

What next?

This is bad news but attempting to predict the markets movements at a time of high volatility is as likely to be wrong as it is to be right.

Hold fast

China has reported the lowest number of new infections since the virus was discovered.

There is a “bell curve” to this infection which follows a pattern of reported cases rising, peaking and then falling and that pattern will prevail.

Share prices will rise

The fundamental issue is the widespread fear that commerce, which depends on the free transmission of goods and services, could collapse.

We don’t think that will happen.

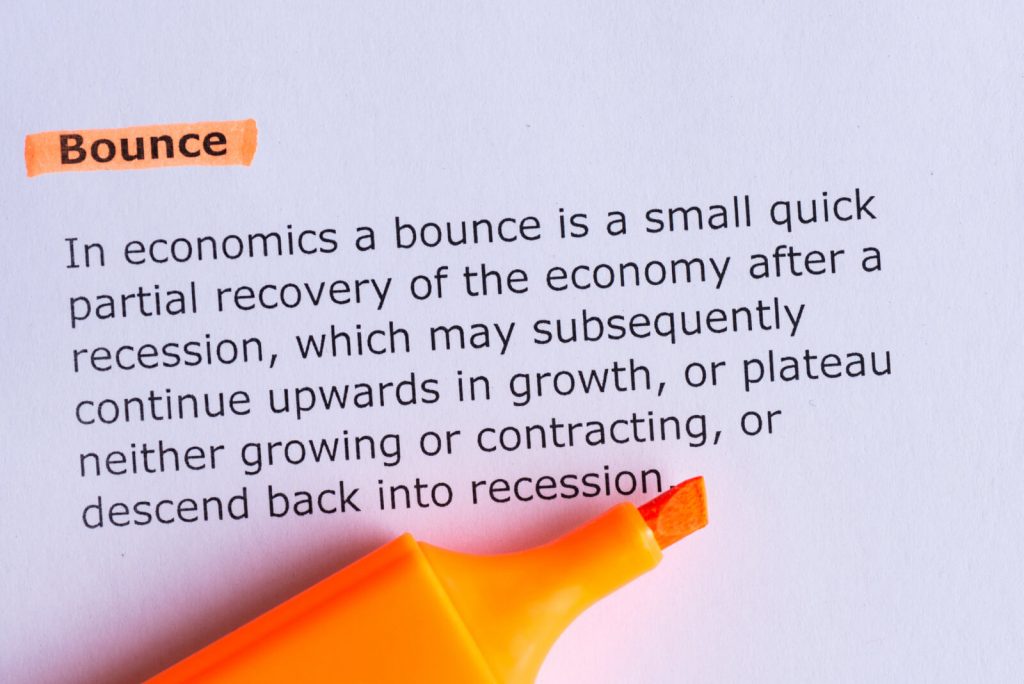

The harder the fall

The greater the bounce back. Overall, in the next three to five years, quality businesses will grow.

Profits will be made and order will be restored.

You hold many of those good quality companies in your funds and their qualities and capabilities have not gone away.

We suggest that it is a case of “keeping calm and carrying on” and the crisis will pass.